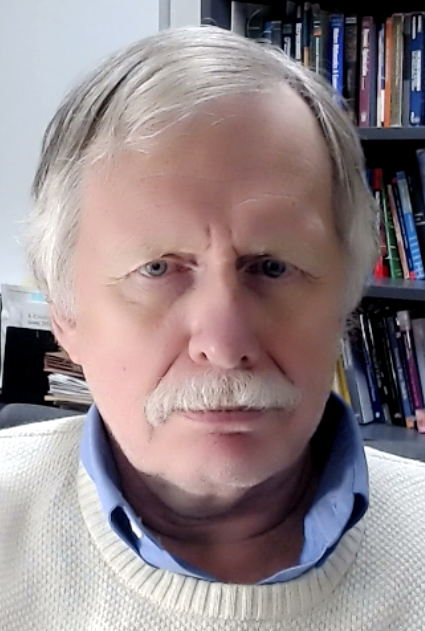

Dr. David Nickerson

Overview

The focus of Dr. Nickerson’s research includes the economics of natural disasters, competition and efficiency in secondary financial markets, lending discrimination, contingent debt valuation and renegotiation, and sustainable communities and property risk. Dr. Nickerson’s current teaching is in real estate finance and sustainable development..

Prior to his appointment at Ryerson, Dr Nickerson was a Senior Financial Economist in the Research Office of the Consumer Financial Protection Bureau, the inaugural Bennett Chair in the Heller College of Business at Roosevelt University and Deputy Chief Economist at Freddie Mac. He has been a professor of economics and finance at Duke University, Colorado State University, American University, the University of British Columbia and the University of Canterbury, and has also served as Senior Economist at the Office of Thrift Supervision and the United States Treasury, a Research Scholar at the Federal Reserve Banks of Kansas City and St. Louis, a consultant to the International Development Research Centre in Ottawa and a Special Advisor to the national governments of Vietnam and the People’s Republic of China. He is also a consultant in financial markets at NERA in New York and Washington, D.C.

Dr Nickerson is currently the Editor-in-Chief of the refereed journal International Finance and Banking,, a member of the board of editors of the SN Journal of Economics and Business and a Guest Editor of a special issue on risk and insurance in the Journal of Risk and Financial Management.

Dr. Nickerson holds a PhD in economics from Northwestern University (1982).

The focus of Dr. Nickerson’s research iincludes the economics of natural disasters, competition and efficiency in secondary financial markets, lending discriimination, contingent debt valuation and renegotiation, urban property risk, and sustainable community development. Dr. Nickerson’s teaching activities are in the areas of real estate finance and sustainable real estate.

| Books and Monographs |

|---|

| The Vancouver Stock Exchange: Its Contribution to the Economy of British Columbia, (with M. Courchane), Ministry of Finance, Government of British Columbia Publications Office, (1989). |

| Doi Moi and Productivity in the Socialist Republic of Vietnam: Studies of Four Economic Sectors, (ed.) Institute of Economics, National Centre for the Social Sciences , Hanoi (1994) |

| Financial Markets in Economic Development and Transition, (with D. Schydlowski and L. Sawers), World Scientific Press, London and Singapore, (2000) |

| Refereed Journal Publications |

| “Intertemporal Incentive Allocation in Simple Hierarchies,” (with Todd Sandler), Mathematical Social Sciences, Summer 1984, 33-57. |

| “Systematic Monetary Neutrality in Models with a Disequilibrium Price Level,” Economics Letters,January 1984, 1-8. |

| “Optimal Monetary Policy with a Flexible Price-Setting Rule,” Kredit und Kapital, Heft 3, Spring 1985, 289-298. |

| “A Theorem on Policy Neutrality,” European Economic Review, August 1985, 331-345. |

| “Monetary Neutrality and Optimality in Equilibrium Models with a Wealth Effect,” Canadian Journal of Economics, August 1987, 612-624. |

| “Monetary Optimality with Symmetric Partial Information,” (with Marsha Courchane), International Journal of Economics, Winter 1988, 57-73. |

| “Self-Insurance Against Natural Disasters,” (with Tracy Lewis), Journal of Environmental Economics and Management, May 1989, 209-223; reprinted in Kunreuther, H. and A. Rose (eds), The Economics of Natural Hazards (International Library of Critical Writings in Economics), Edward Elgar Publishing, 2004. |

| “Optimal Futures Market and Buffer Stock Strategies for Commodity Price Stabilization,” (with Marsha Courchane), Selected Papers of the Fourth International Futures Conference and Research Seminar, (ed. Lloyd Besant), Canadian Futures Institute, Toronto, 1990, 10-42. |

| “Monetary Neutrality and Optimality in Equilibrium Models with Private Information and a Single Asset,” Economic Studies Quarterly, August 1991, 1-27. |

| “Exchange Rate Uncertainty and Precommitment in Symmetric Duopoly: A New Theory of Multinational Firms,” (with S. Khoury and V. Sadanand), Recent Developments in International Banking and Finance, volume 4, Summer 1991, 12-36. |

| “Monopoly Investment, Pricing and Production under Intertemporal Demand Uncertainty,(with S. Reynolds), Australian Economic Papers, Fall 1995. |

| “Strategic Delay and Endogenous Offers in Bargaining Games with Private Information,”(with A. Sadanand and V. Sadanand), Journal of Economics (Zeitschrift fur Nationalokonomie), Winter 1994/95, v. 60, no. 4, pp. 125-54. |

| “Governance and Efficiency in Emerging Financial Markets,” Journal of International Trade and Economic Development, December 1995, pp. 261-282. |

| “Endogenous Competition and Strategic Foreign Production,” (with V. Sadanand), Canadian Journal of Economics, April 1996, pp. 19-26. |

| “Lending Discrimination Resulting from Overage Practices,” (with M. Courchane), Journal of Financial Services Research, February/April 1997, pp. 133-152. |

| “Estimation and Evaluation of Loan Discrimination -- An Informational Approach,” (with M. Courchaneand Amos Golan), Journal of Housing Research, Volume 11, Issue 1, Spring 2000, pp. 67-90 |

| “Strategic Real Options and Endogenous Competition in Electronic Banking,” (with M. Courchane and V. Sadanand), Control Applications of Optimization 7(1) 2000, 104-109 |

| “Public Income Transfers and Private Insurance Against Environmental Disasters,” Proceedings of the Risk Theory Society 2000, (ed. R.Butler), S. S. Huebner Foundation and American Risk and Insurance Association, July 2000 |

| “Lessons Learned: Application of Statistical Techniques to Fair Lending Compliance Examinations,” (with M. Courchane and D. Nebhut), Journal of Housing Research,Volume 11, Issue 2, Fall, 2000, pp. 277-95 |

| “Mortgage Contracts, Strategic Options and Stochastic Collateral,” (with R. Jones), Journal of Real Estate Finance and Economics, Volume 24, Issue 1, January, 2002, pp. 35-58. |

| “Investment in Internet Banking as a Real Option: Theory and Tests,” (with R. Sullivan) Journal of Multinational Financial Management, Vol 12, 4-5, December 2003, 347-363. |

| “Regulating Financial Markets: Assessing Neoclassical and Institutionalist Views,” (with R. Phillips), Journal of Economic Issues, Summer 2003. |

| “Crime and Residential Mortgage Default: An Empirical Analysis,” (with R. Feinberg), Applied Economics Letters, April 2004, pp.114-118 |

| “Assessing Systemic Risk Exposure from Housing GSEs and Banks under Alternative Approaches for Capital Adequacy,” (with P. Kupiec), Journal of Real Estate Finance and Economics, Volume 28(2), 2005, 123-45. |

| “Insurers Are Not Banks: Assessing Liquidity, Efficiency and Solvency Risk,” (with P. Kupiec), Geneva Papers on Risk and Insurance, Fall 2006. |

| “Private Investment, Public Aid and Endogenous Divergence in the Evolution of Urban Neighborhoods” (with L. Arvan), Journal of Real Estate Finance and Economics, January/February 2007 |

| “Dynamic Monitoring of Financial Intermediaries with Subordinated Debt,” (with G. Gonzalez-Rivera), Journal of Risk Finance, Vol 9, No. 5, 2008 |

| “Underwriting Risk, Stabilizing Regulations and Property-Liability Insurance Volatility,” (with A. M. B. Hogan), Control Applications of Optimization, 23(1), 2010. |

| “Political Economy of Presidential Disaster Declarations and Federal Disaster Assistance,” (with T. Husted), Public Finance Review, vol 42(1), January 2014, 35-57. |

| “Strategic Selection and Asset Price Risk in Mortgage Markets,” Journal of Economic Research and Studies, Vol. 11(10), 2016, 123-141 (https://doi.org/10.5514/jers.v11n10p141) |

| “Credit Rationing and Rational Lending Discrimination,” International Review of Economics & Finance, Vol. 8(10), 2016, 140-158 (https://doi.org/10.5539/ijef.v8n10p140) |

| “Asset Price Volatility and Efficient Selection in Credit Market Equilibrium,” International Journal of Business and Finance Research, Vol. 10(4), 2017, 91-101 (https://www.theibfr.com/download/IJBFR/2016-ijbfr/ijbfr_v10n4_2016/IJBFR-V10N4-2016-8.pdf) |

| Property Risk, Foreclosure Costs and Credit Discrimination,” (with D. Scofield), International Finance and Banking, Vol. 4(1), 2017, 121-144. (https://doi.org/10.5296/ifb.v4i1.10089) |

| “Collateral Risk and Demographic Discrimination in Mortgage Market Equilibria,” (with R. Jones), Review of Economics and Finance, Vol. 9(3) , 2018, 13-28. (www.bapress.ca/ref/ref-article/1923-7529-2017-03-13-16.pdf) |

| “Insurance Cycles, Spanning and Regulation,” (with A. Hogan), Journal of Economics and Public Finance, Vol 5(4), 2019, 465-472. (https://doi.org/10.22158/jepf.v5n4p465 ) |

| “Disaster Risk, Moral Hazard and Public Policy,” (with T. Husted), Natural Hazards Science, Oxford Research Encyclopedias, October 2020, 1-43. (https://doi.org/10.1093/acrefore/9780199389407.013.195) |

| “Private Support for Public Disaster Aid,” Journal of Risk and Financial Management, June 2021, p 14-27 (https://doi.org/10.3390/jrfm1406024) |

| “Credit Risk, Regulatory Costs and Lending Discrimination in Efficient Mortgage Markets,” Journal of Risk and Financial Management, v. 15(4), July 2022 1-17. (https://doi.org/10.3390/jrfm15050197) |

“Governors and Electoral Hazard in the Allocation of Federal Disaster Aid,” (with T. Husted), Southern Economic Journal v.89(2), October 2022 522-539 (https://doi.org/10.1002/soej.12603 |

| “Natural Disasters and Sustainability: Can Private Capital Finance Community Recovery?” Annals of Social Science and Management Studies, v.8(1), December 2022 1-8. (https://doi.org/10.19080/ASM_2022.08.555728) |

| Book Chapters, Reviews and Non-refereed Journal Publications |

| “Inventory Investment in the Current Business Cycle,” Financial Letters, Federal Reserve Bank of Kansas City, October 1985. |

| “Money Demand and Monetary Policy,” by Douglas Fisher (book review) Journal of Economic Literature , vol. 30, No. 1, March 1992, pp.197 - 199. |

| “Economic Development and Industrial Restructuring in Vietnam: A Summary of Macroeconomic Performance and Comments on Conference Papers,” in Proceedings of the First IDRC Conference on Vietnamese Economic Restructuring , I.D.R.C., Singapore, 1993. |

| “Ensuring Failure: Financial System Stability and Deposit Insurance in Canada,” by J. Carr, F. Mathewson and N. Quigley, (book review), Canadian Public Policy, December 1995. |

| “Financial Deja Vu: The Farm Credit System’s Past Woes Could Strike the Federal Home Loan Bank System,” (with R. Phillips), Regulation, (Cato Institute), Spring 2002, 36-41. |

| “Restructuring, Stabilizing and Modernizing the New Russia: a Review,” by Paul J. Welfens, and E. Gavrilenkov, Journal of International Trade and Economic Development, 2005. |

| “The Federal Home Loan Bank System and the Farm Credit System: Historical Parallels and Implications for Systemic Risk,” in Gup, B. (ed), Too Big to Fail: Policies and Practices in Government Bailouts, Greenwood Publishing Group, 2007. |

| “Property-Casualty Insurance Markets: Regulation, Risk and Volatility” (with R. Phillips), Network Financial Institute Annual, 2012 |

| Practitioner and Professional Publications |

| “Adverse Selection and Prior Arrest History in Military Recruiting,” (with D. Gregory and H. Griffis), CRM Papers 96-13, November 1996, Center for Naval Analyses, Alexandria, Virginia |

| “Defined-Contribution and Defined-Benefit Pension Plans for Military Retirement,” CIM Papers 97-06, February 1997, Center for Naval Analyses, Alexandria, Virginia. |

| “Predicting Re-enlistment, Separation and Extension Rates in Naval Manpower Planning,” CAB Papers September 1998, Center for Naval Analyses, Alexandria, Virginia. |

| “Future Force Formulation: Combined Conditional and Multinomial Logit Estimation of the Effects of the Targeted Enlistment Bonus, 1994-1997,”CAB Papers, August 2000, Center for Naval Analyses, Alexandria Virginia. |

| “An International Comparison of Residential Mortgages: Equity, Fixed Rates, Long Maturities and Prepayment,” (Policy Briefings Series, Office of the Chief Economist, Freddie Mac, 2003) |

| “Comparing Domestic and Foreign Housing Markets: Tenure Choice, Homeownership Rates, Public Subsidies and Relative Competition and Concentration between Domestic and Foreign Brokerage Services and Mortgage Lenders,” (Policy Briefings Series, Office of the Chief Economist, Freddie Mac, 2004) |

| “Measuring Competition and Efficiency among Financial Market-Makers: The Case of the Housing GSEs,” (Policy Briefings Series, Office of the Chief Economist, Freddie Mac, 2005) |

| Selected Discussion Papers |

| Mortgage Markets, Valuation and Regulation “Endogenous Competition, Efficiency and the Optimal Structure of Secondary Mortgage Markets” “Small Business Investment in Urban Neighborhoods: Effects of Strategic Default and Foreclosure Options on Commercial Mortgage Lending” |

| Property and Community Risk, Sustainability, Natural Disasters and Public Aid “Implementation and Limited Liability in Environmental Disasters:: an Agency Model of Public Aid Transwers” (with L. Arvan), “Community Networks and the Decision to Insure Against Environmental Harm” “Estimating the Likelihood of Environmental Catastrophes: the Relative Efficiency of Private versus Public Announcements of Disaster Forecasts” |

| Intermediated Financial Markets and Applications to Mortgages and Property Insurance“Does Zero-Beta Accurately Measure Catastrophe Bond Risk?” (with A.M.B. Hogan)“Flexibility and Strategy for Small Businesses: Measuring Entry Value as a Real Option” “Residential Housing Insurance and Reinsurance: Efficiency, Solvency Risk and Optimal Market Structure” |

| Contingent Valuation: Applications to Real Assets “Privatizing the Secondary Mortgage Market and the Use of Insider Information,” (with Jim Wilcox) “Uncertainty, Cost-Benefit Analysis and Contingent Claims Valuation: An Empirical Application to Urban Unemployment and the National Manpower Training Act,” with R Lerman (presented at Annual APPAM Meetings) “Applications of Contingent Asset Valuation and Real Options to Military Procurement Decisions: Optimal Replacement vs Maintenance Policies for a Seasoned Weapons System,” (Invited Presentation to the Rand Corporation) “Residential Housing Insurance and Reinsurance: Efficiency, Solvency Risk and Optimal Market Structure” |

| Selected Research Projects in Progress |

| “Could Homeowner Assistance Programs Trigger Endogenous Waves of Mortgage Default?” |

| “Unregulated Externalities and the Credit Risk of Mortgage Debt Issues with Joint and Several Liability” |

| “Catastrophes and the Effects of Public Recovery Aid on Debtholders of Property Development in At-Risk Communities:” |

| “Alternative Criteria to Economic Efficiency: Law and the Causation of Harm Doctrine” |

| “The Adverse Possession Doctrine in Property Law: Using Option-Pricing to Estimate Damages |

| Selected Conference and Seminar Presentations (2014 – 2024) |

80th Midwest Political Science Association Conference (2024) |

35th Global Conference on Business and Finance (2024) |

4th Global Experts Conference on Applied Science, Engineering and Technology (Plenary Speaker) |

University of Colorado Environmental and Resource Economics Conference |

University College London, Bartlett School, Economics and Finance Department |

78th Midwest Political Science Association Conference |

| 30th Annual Australasian Finance and Banking Conference

|

Western Risk and Insurance Association Annual Conference |

American Risk and Insurance Association Annual Meetings |

Southern Risk and Insurance Association Annual Meeting |

Annual Meeting of the Southern Finance Association |

ASSA Annual Meetings (American Economic Association) |

AREUEA Annual International Conference |

Otago University, School of Business, Department of Finance |

Bank of England Conference on Systemic Risk |

American Finance Association Annual Meetings |

University of Minnesota, Carlson School of Management |

| Annual Maastricht-Cambridge International Symposium on Real Estate Finance and Investment, National Academy of Sciences Colloquium on Environmental Change and Social Policy |

University of Reading, Henley School of Business |

Bournemouth University, School of Management |

Appointment to editorial board of new economics journal (Global Journal of Economics, Business and Management) (April)

| Research Funding |

|---|

| Duke University Faculty Research Grant |

| UBC-SSHRC Research Grant |

| UBC-HSS Research Grant |

| Research Grant, Centre for International Business Studies Canada |

| SSHRC Travel Grants for International Conference |

| NSF Research Grant (secondary investigator) |

| University Research Award, American University |

| U.S. Mortgage Bankers Association Research Grant |

| Bennett Foundation Research Grant |

| Memberships in Professional Societies |

|---|

| American Economics Association |

| American Real Estate and Urban Economics Association |

| Asian Real Estate Society |

| Canadian Economics Association |

| Financial Intermediation Research Society |

| International Insurance Foundation |

| Risk Theory Society |