External Debt Management Policy

- Owner: Financial Services

- Approver: Board of Governors

- Approval Dates: April 24, 2023; October 1, 2024

I. Purpose

The purpose of this Policy is to provide a framework for the management and oversight of the University’s capital assets that are core to the University’s achievement of its mission. To achieve this, it is important to have a framework for the undertaking of new long-term external financing to ensure debt borrowing is aligned with the University’s principles and priorities in its capital plan and only undertaken by the University following the approval of the Board of Governors.

The use of long-term external financing may not be used to support operating activities as this would be covered with short-term financing arrangements.

Furthermore, this policy outlines the specific metrics to be used in assessing the overall debt capacity and debt affordability of the University. As the University evaluates the use of debt for strategic capital priorities and to create financial flexibility, the metrics outlined in this Policy will be reflected in those decisions.

II. Scope and Application

This Policy applies to all faculties, administrative units, and Affiliated Entities.

No organizational unit or Affiliated Entity of the University are allowed to enter into any debt agreements on behalf of the University.

III. Definitions

“Affiliated Entity” means a separately incorporated entity that is wholly or substantially owned by the University and whose financial activities are included in the consolidated financial statements of the University.

“Bridge-financing” means the use of short-term or interim financing until such time that permanent financing is obtained.

“Debt-to-FTE” means the ratio of external debt outstanding to the number of full-time equivalent “FTE” students.

“Expendable Net Assets” means the assets of the University that are not required to be retained in perpetuity including, but not limited to, unrestricted surplus (deficit) plus internally restricted net assets and internally restricted endowments, adjusted for the non-cash component of employee future benefits.

“MCU” means the Ministry of Colleges and Universities.

“Long-Term Debt” means the external long-term debt as disclosed in the institution’s financial statements without adding the current portion.

“Sinking Fund” refers to a pool of funds set aside by the University for the purpose of accumulating sufficient funds for the repayment of a portion or all of the principal due at maturity on non-amortizing debt.

“University” means Toronto Metropolitan University.

IV. Policy

1. Objectives

To achieve the twin goals of prudent financial risk management and to minimize external borrowing and debt servicing costs, the University shall consider the use of selected financing strategies, including, but not limited to, Bridge-financing, derivative products, short and long term, and fixed and variable rate debt.

The University will consider its assets, liabilities, unrestricted cash flows, and operating budget, along with current market conditions when evaluating financing options. The University has implemented key financial ratios to assess the financial viability of incurring additional debt. These ratios are also included as part of the financial health metrics monitored by the MCU.

2. Debt Policy Ratios

This policy establishes University-wide guidelines used to determine the maximum amount of external debt that can be carried on the University’s balance sheet at any given time. These guidelines are implemented through the monitoring of four key financial ratios based on the University’s balance sheet resources and annual operations, and are measurements of the University’s debt affordability and debt capacity. These ratios can be derived from the University’s financial statements and are subject to periodic review.

(a) Viability Ratio

Viability ratio is an indicator that measures debt capacity, as it provides an indication of the funds on hand that can be used should an institution be required to settle its long-term obligations. It is measured as a ratio and is calculated as Expendable Net Assets over Long-Term Debt (as illustrated below).

Viability Ratio = Expendable Net Assets ÷ Total External Long Term Debt

The University has established a target Viability Ratio threshold of 30% or greater, indicating that the University must have unrestricted and internally restricted financial assets that are at least 30% of its long-term debt balances.

(b) Interest Burden Ratio

Interest Burden ratio is a measure of debt affordability that compares the level of current debt service with the institution's total expenses. It examines the proportion of total expenses supporting the annual cost of servicing debt. The ratio is calculated as interest expense over total expenses adjusted for depreciation (as illustrated below).

Interest Burden Ratio = Interest Expense ÷ Total Operating Expenses (less depreciation)

The University has established a target threshold of less than or equal to 2% to ensure that sufficient coverage is available for interest payments without jeopardizing potential funds available for other internal purposes.

(c) Debt Ratio

Debt Ratio is an indicator of debt capacity, as it measures the percentage of total assets owed to external lenders. The ratio is calculated as total debt adjusted for deferred capital contributions over total assets (as illustrated below).

Debt Ratio = Total External Debt Less Deferred Capital Contributions ÷ Total Assets

The University has established a target threshold of less than or equal to 55%, indicating that no more than half of its total assets are to be owed to lenders.

(d) Debt to Revenue Ratio

Debt to Revenue Ratio is a measure of debt affordability that measures the proportion of revenue that is used to cover the institution’s long-term debt. The ratio is calculated as total long-term debt over total revenues (as illustrated below).

Debt to Revenue Ratio = Total Long-Term Debt ÷ Total Revenues

The University has established a target threshold of less than or equal to 50%, indicating that long-term debt should be no more than half of its total revenues.

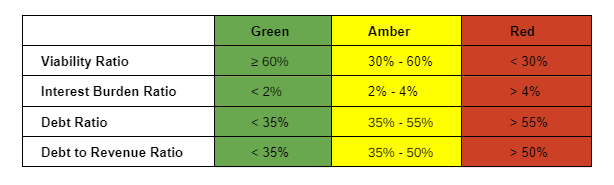

(e) Debt Policy Ratio Ranges

The key debt policy ratios should be assessed as follows:

Green: Debt ratios falling within this range would be considered acceptable within this policy.

Amber: Debt ratios falling within this range would not automatically disqualify the addition of external debt but would entail a careful assessment of the merits of incurring such debt and recommendations on how to return the policy ratio(s) to lower ranges.

Red: Debt ratios falling within this range would require the careful assessment of both the magnitude and the duration of these levels and only under extreme circumstances would incurring additional debt be considered.

(f) Other Financial Metrics for Monitoring

Additional ratios will also be monitored annually after the fiscal year-end is completed, in order to provide a more complete understanding of the University’s credit and financial profile.

(g) Other Considerations

The impact to the University’s credit rating will be considered in all debt financing considerations. The University understands that financial ratios and thresholds are not intended to target a specific credit rating, but rather to ensure the long-term financial health and sustainability of the University. The use of debt financing will not be dictated solely by external credit rating or external party considerations.

3. Sinking Fund

The University may maintain a voluntary Sinking Fund to set aside sufficient funds to repay a portion of, or the total principal amount due at maturity on its non-amortizing external debt. The sources of cash inflows for the Sinking Fund may include budgetary allocations or savings generated from capital projects and operating funds.

The University will consider the Sinking Fund as a part of its internally restricted net assets and therefore categorize such funds as expendable funds. As such, any Sinking Funds will be treated similar to other internally restricted reserves.

The Sinking Fund shall be invested with the objective of maximizing investment returns over a similar time horizon as those of the University’s non-amortizing debt, and subject to goals of matching cash flows and preserving capital.

As the Sinking Fund will normally have a long-term profile, any investments of the Sinking Fund shall be made in accordance with the University’s investment policies.

V. Roles and Responsibilities

Financial Services shall monitor and the University’s Chief Financial Officer will report to the Finance Committee at least annually on the following:

1. Details of current and projected debt levels including term and rates;

2. Historical trends of debt policy ratios;

3. Compliance to covenants or obligations relating to any indebtedness of the University;

4. That there are no market events or changes to the terms or conditions of existing debt that may impact the University’s financial position in a negative manner;

5. That the University management has strategically reviewed the overall debt portfolio to ensure that it is optimized to take advantage of prepayment and hedging opportunities, that interest costs are minimized, and that the debt structure is appropriate in the context of the current market environment;

6. Other financial metrics and considerations as contained in this policy;

7. The value of the Sinking Fund investments relative to its projected target; and

8. Credit rating updates and commentaries.

VI. Jurisdiction

This Policy falls under the jurisdiction of the Chief Financial Officer.

VII. Next Review Date

This Policy will be reviewed at least annually to ensure consistency with the University’s objectives and the external environment.